Start Up Business Loans

Water Street Capital is a top level financier of small businesses in the USA and Canada.

Finance For Small Business

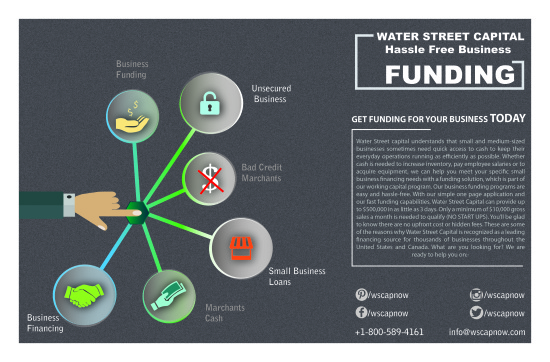

Water Street capital understands that small and medium-sized businesses sometimes need quick access to cash to keep their everyday operations running as efficiently as possible.

Merchant Cash Advance Business

Whether cash is needed to increase inventory, pay employee salaries or to acquire equipment, we can help you meet your specific small business financing needs with a funding solution, which is part of our working capital program.

Business Financing Loans

Our business funding programs are easy and hassle-free. With our simple one page application and our fast funding capabilities, Water Street Capital can provide up to $500,000 in as little as 3 days.

Unsecured Personal Loans

Only a minimum of $10,000 gross sales a month is needed to qualify (NO START UPS). You'll be glad to know there are no upfront cost or hidden fees. These are some of the reasons why Water Street Capital is recognized as a leading financing source for thousands of businesses throughout the United States and Canada.

Thursday 13 July 2017

How Unsecured Business Loans Help in the Success Path For Your Business?

Monday 10 July 2017

Top 5 Tips For Merchant Cash Advance Loans

Thursday 6 July 2017

Why Unsecured Business Funding Loan Is the Best Option for Small Business ?

- Rate of interest – a reasonable rate such as 20% is acceptable

- Waiver of upfront processing fees

- Flexible repayment schedule that can be fixed between one to three years

Wednesday 5 July 2017

Why Small Business Loan is Very Important for Small Businessmen?

How to apply for a small business loan online?

Monday 5 June 2017

Top Questions You Should Ask Before You Get a Business Financing Loan

Is it secured or unsecured?

Interest rate?

Processing fees, upfront fees?

How fast is the loan available?

Is high credit scoring a must?

Documentation

Blog source: Blog Source: http://www.wscapnow.com/blog/

Thursday 11 May 2017

Top Reasons to Apply For Merchant Cash Advance

What is a merchant cash advance?

Immediacy

Expand activities

Learn How to be Prepared to Apply for Small Business Finance (Infographic)

WSCapnow small business loans target the entrepreneur who wishes to take the next big leap or the small business owner who is faced with temporary setbacks. Any running small business can avail of small business finance through Water Street Capital and be assured of fast financing on soft terms.

Know more: http://www.wscapnow.com/small-business-loans/

Tuesday 9 May 2017

Why Choose Unsecured Business Funding for Business?

Wednesday 3 May 2017

Friday 28 April 2017

Top Advises for Small Business Loans with Bad Credit

Never settle for the first one available

Consider opting for small amounts

Pay off all debts and all bills

Look for business credit card and lines of credit

Focus on cash flows

Tuesday 25 April 2017

Water Street Capital: Get Funding for your Business Today

Thursday 13 April 2017

Bad Credit Small Business Loans in Canada - The Best Fuel for Your Business Growth

Anyone who is mired in financial difficulties and with a poor credit rating knows how difficult it is to obtain finance that will help them keep their business operational and even grow. Such business loans for small businesses are ideal. Applicants need to submit only minimum documentation for fast approval. Terms are easy in that no mortgage or guarantee is required for business loans. Importantly, loans repayment may be spread out over a year or even more thus easing the financial burden. The result is that a cash stifled business gets the necessary infusion of funds to help it overcome temporary difficulties. It can grow and reverse its situation.

The important thing is survival. Infusion of cash in the form of business loans help businesses stay alive and, with guidance from experts from the loan providers, get back on track. Once they do, the same loan providers can keep on providing more funds in various ways to help the businessman grow and expand. The higher cost is offset by rapid growth and increased revenues.

Wednesday 12 April 2017

Why Merchant Cash Advance Loans Are suitable Choice in These Days?

Thursday 6 April 2017

Are You Ready to Apply for Unsecured Business Funding?

Tuesday 4 April 2017

Get Risk Free Loans for Your Small Business

How is small business loan risk-free?

Varied purpose of small finance loan -

-

Financing project -

-

Finance for equipment -

-

Operation cost -